- Many long-term holders of XRP changed addresses, but may not be in an offer to sell.

- Short-term participants made slight gains, however, the token remained undervalued

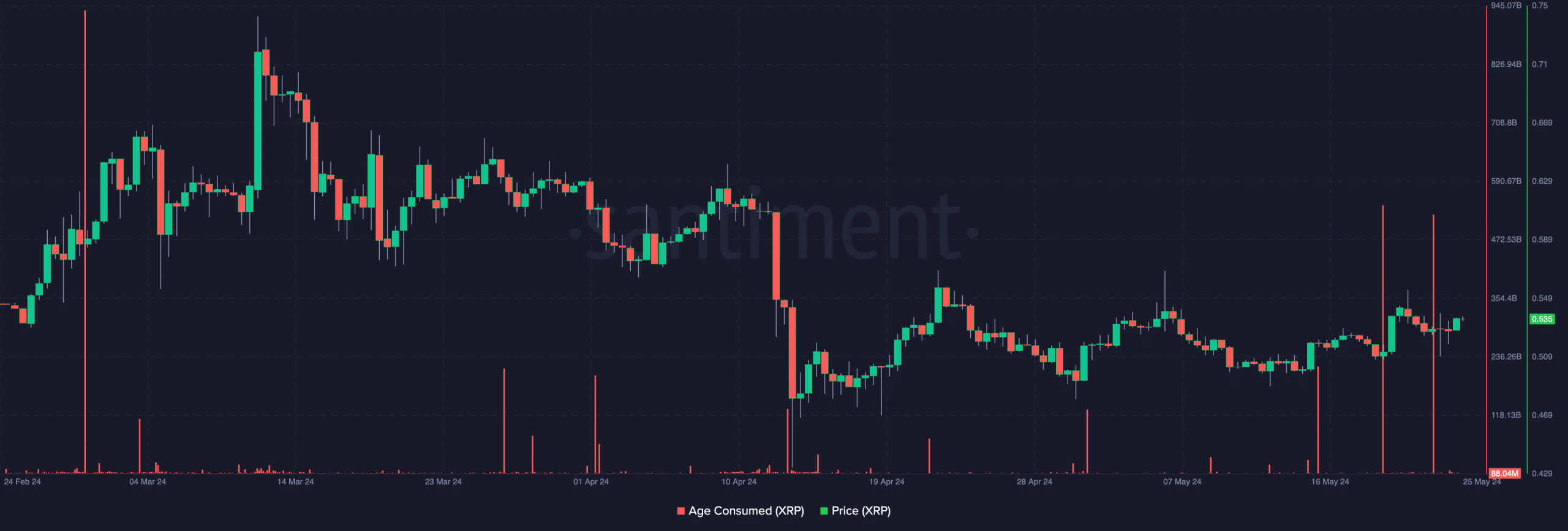

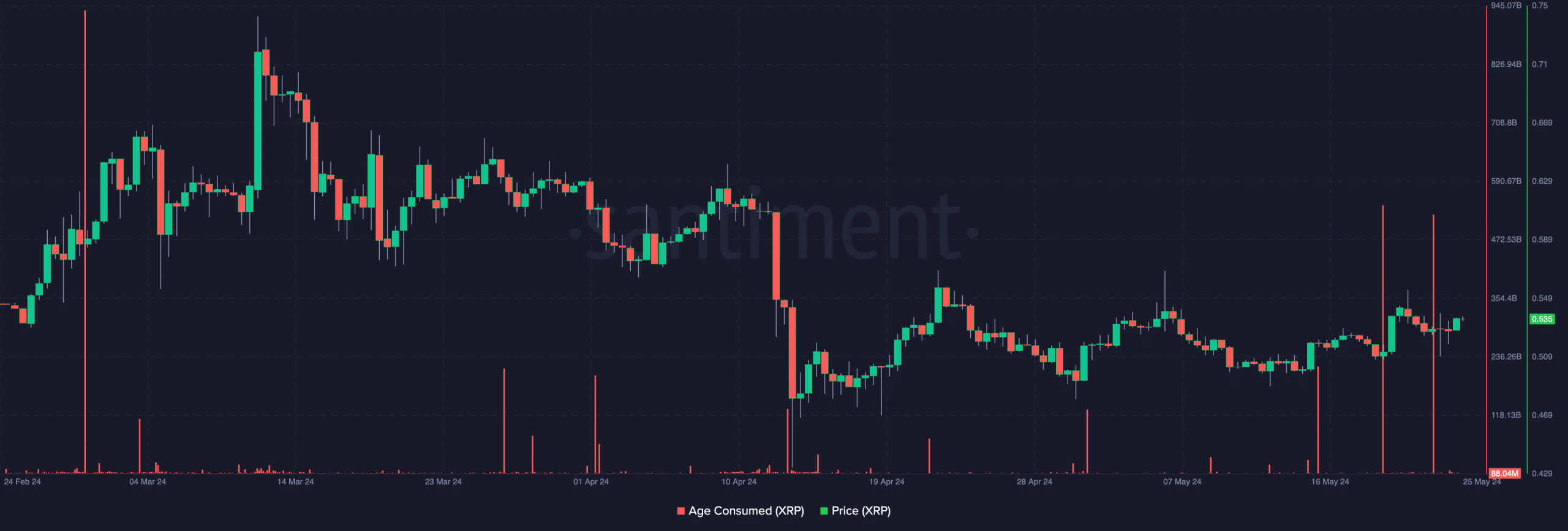

In less than two weeks, XRP’s age-old consumption metric has rebounded from major lows three times. The first time was on May 16 when the metric rose to 214.86 billion.

On May 20, it went off limits and reached 539.79 billion, and on May 24, the metric rose again, indicating a significant movement of tokens from long-term holders.

For those unfamiliar, Age Consumed tracks the amount of tokens that change addresses within a given period. When the metric increases, it means that a large number of previously idle tokens are on the move.

On the other hand, a low reading suggests that long-term holders have kept most of their assets in the same portfolio. After the recent market rally, participants can assume that holders are planning to sell their XRP.

Source: Sentiment

XRP to trade between $0.50 and $0.55

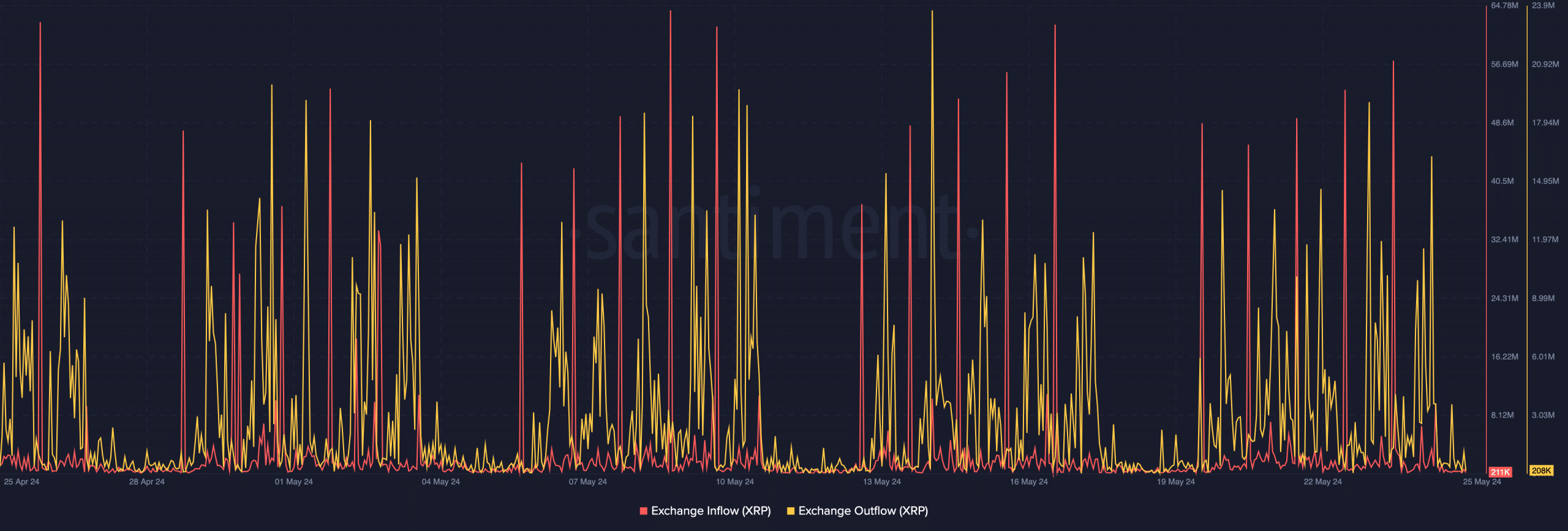

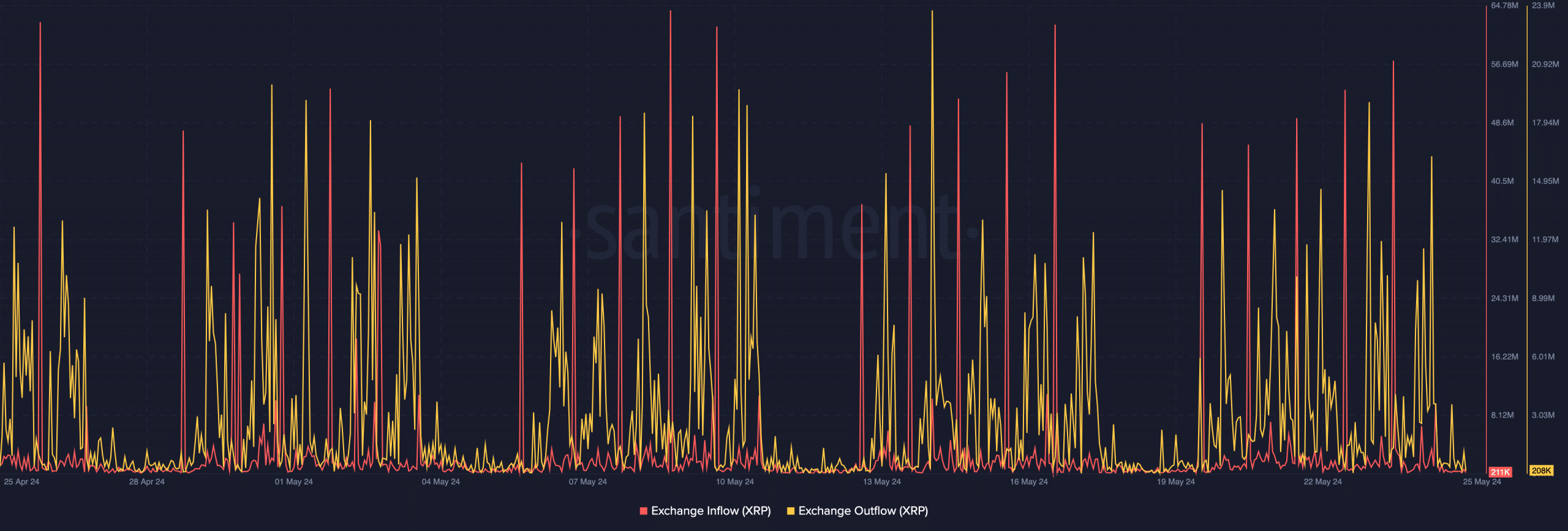

However, drawing conclusions without evidence from other metrics may seem too hasty. As such, AMBCrypto evaluated exchange entries and exits on the XRP ledger.

According to data obtained by Santiment, inflows in exchange for XRP were 211.00. Exchange inflows measure the number of tokens sent from external wallets to exchange addresses.

An increase in inflows suggests that most tokens may be for sale. Furthermore, the exchange outflows at press time were 208,000. This metric is the number of tokens sent to non-custodial wallets. In most cases, this action means that the participants involved do not plan to sell anytime soon.

The mild difference in flows indicates that the price of XRP may not be significantly affected by the increased movement of idle coins.

Source: Sentiment

Patrons should be prepared for fireworks

At the time of writing, the price of XRP was $0.53. This value represented an increase of 2.67% in the last 7 days. Going by the on-chain indications, XRP may not register a noticeable increase in the coming days.

However, if the market condition becomes too bearish, the price may fall to the fundamental support of $0.50. Conversely, in a very bullish scenario, XRP could reach $0.55 on the charts.

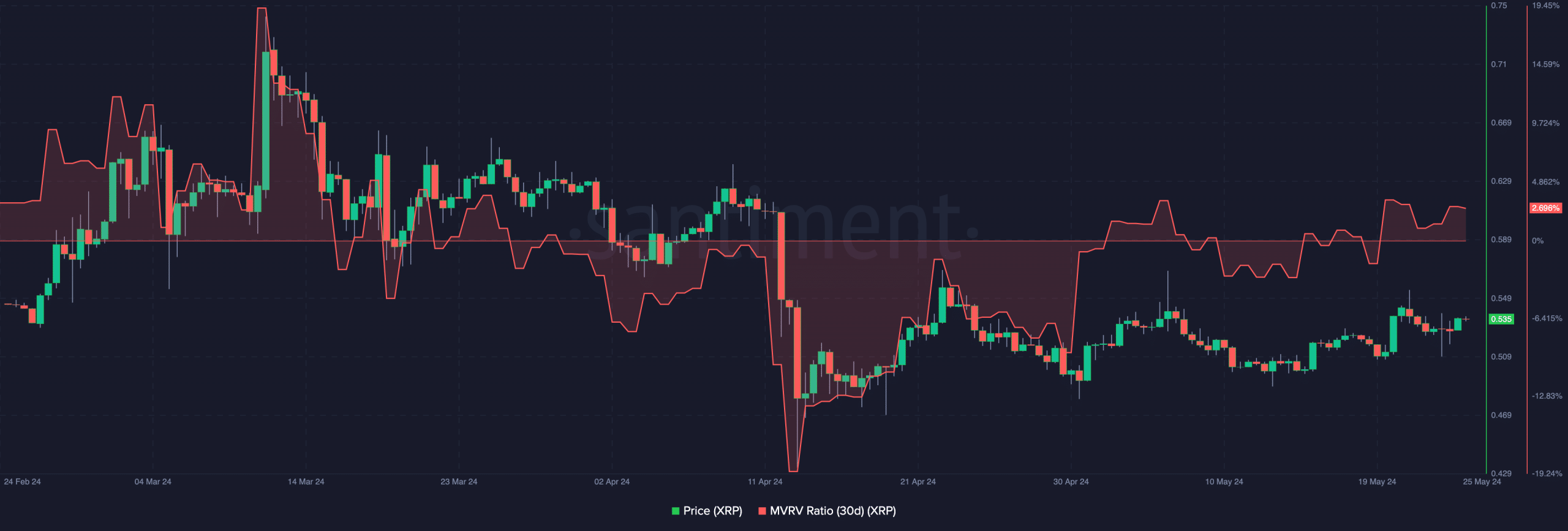

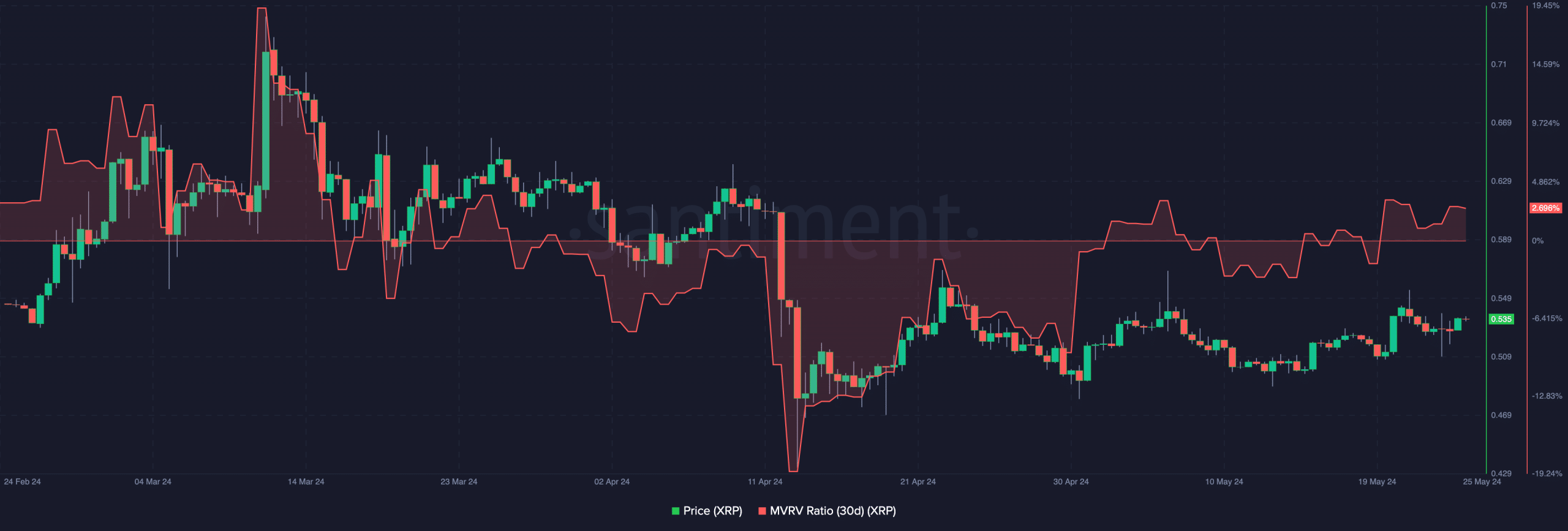

Overall, the short-term forecast seemed to indicate that the stock may remain in a tight trading range. Meanwhile, the market value to realized value (MVRV) ratio showed that more XRP holders have become profitable recently.

At press time, the 30-day MVRV ratio was 2.696%. This means that the average token holder who has accumulated in the last 30 days can get positive returns if they sell.

Source: Sentiment

In addition, the metric measures whether an asset is undervalued or overvalued. From the looks of things, XRP seemed to be undervalued compared to its performance in March.

Read Ripple’s [XRP] Price forecast 2024-2025

Therefore, the price of the token may rise to $0.60 in the medium term. However, the short-term outlook doesn’t exactly look good as XRP could swing sideways as mentioned before.

#Unusual #XRP #Token #Activity #Assessing #Potential #Market #Impact

Image Source : ambcrypto.com